Crypto assets that can be used as instruments of payment have proliferated into more than 10,000 variants since the 2009 debut of Bitcoin, the first and still the largest. The bewildering speed with which they have developed and the pseudonymity they can provide have left tax systems playing catch up.

In a new paper, we discuss how governments can address the emerging challenges of taxing these crypto assets while its use is still limited so that they prevent a leakage in tax revenue and protect the integrity of the tax system.

Classifying crypto

Views of crypto assets are diverse and held with passion. The prospect of liberating financial transactions from oversight by governments and the involvement of financial institutions is a libertarian dream for some. El Salvador and the Central African Republic have gone so far as to adopt Bitcoin as legal tender.

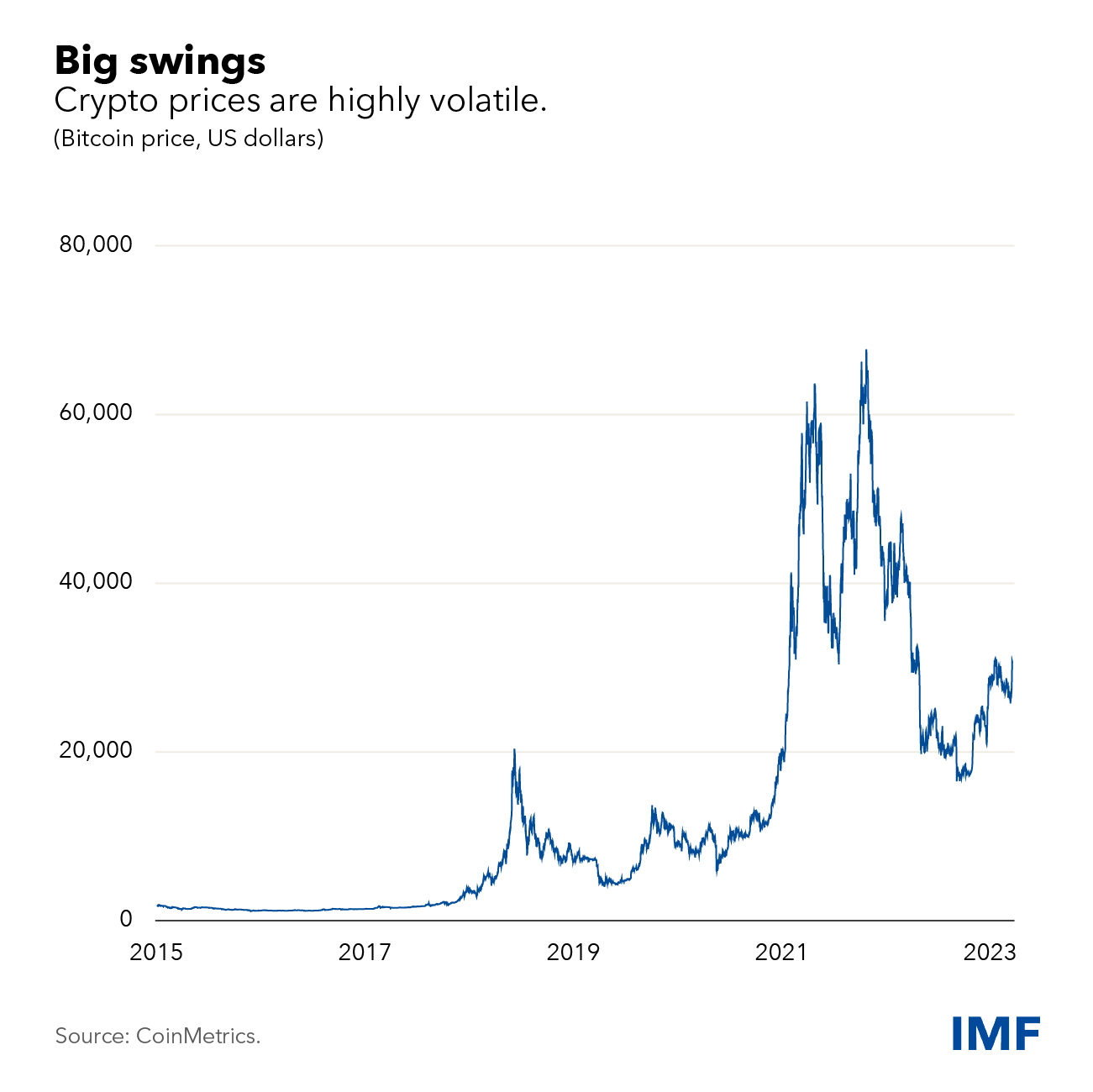

Critics, however, see crypto assets as not merely inherently worthless but a front for crime, scams, and gambling. They also point to their dizzying volatility. Bitcoin, for instance, soared from $200 a decade ago to nearly $70,000 in 2021 before plunging to around $29,000 today.

The collapse of FTX last year and recent US Securities and Exchange Commission lawsuits against Binance and Coinbase have fed anxiety among users while the appeal to criminal activities has been reflected in high-profile seizures of billions of dollars. These developments have triggered increasing scrutiny from policymakers and widespread calls for regulation.

But whether crypto assets ultimately boom or bust, a coherent way to tax them is needed.

A key issue is how to classify crypto assets—should they be regarded as property or currency? When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject to the same sales or value-added taxes, or VAT, that would be applied for cash transactions.

So, one important task is to ensure application of these principles, which requires clarity on how to characterize crypto for tax purposes: in essence, as currencies for VAT and sales taxes and as assets for income tax purposes. While this is not easy due to the evolving nature of crypto asset transactions, it is perfectly possible. The deepest challenges are then in enforcement.

Revenue considerations

Crude estimates suggest that a 20 percent tax on capital gains from crypto would have raised about $100 billion worldwide amid soaring prices in 2021. That is about 4 percent of global corporate income tax revenues, or 0.4 percent of total tax collection.

But with total crypto market capitalization down 63 percent from the late-2021 peak, tax revenues would then have shriveled. If these losses were fully offset against other taxes, there would be a corresponding reduction in revenue. In more normal times and with the current market size, global crypto tax revenues would probably average less than $25 billion a year. That, in the broader scheme of things, is not a huge amount.

Source: MG DIGITAL