Stakeholders in Ghana’s banking industry are elated about the Bank of Ghana’s directive to have the Ghana card as the sole ID card to be used for financial transactions.

This is because they believe this will check fraud and sanitise the country’s financial system in its entirety.

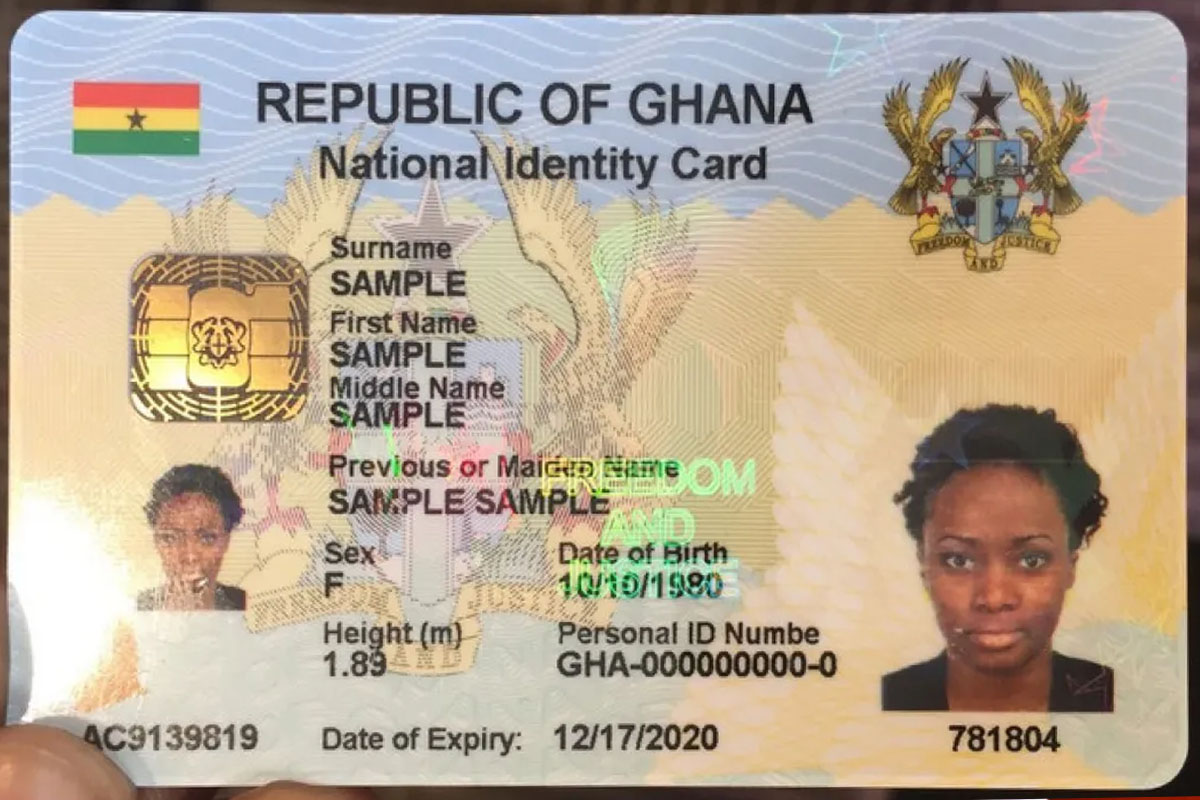

The Bank of Ghana, on Wednesday, served notice to all licensed financial institutions and the general public that effective July 1, 2022, the Ghana Card shall be the only identification card accepted for any form of banking or financial transactions in the country.

This development has come as good news to stakeholders in the banking sector.

Banking Consultant, Nana Otuo Acheampong, believes this integration will make it easier to track persons who fail to pay back non-performing loans.

“It is a good thing in the sense that the multiplicity of ID cards has not helped the system, so now, going mono with a single ID card will help with the tracing and tracking issue. Now, the problem some of the financial institutions have been having is with the non-performing loans, coming from the fact that when someone borrows, they move on, and then you cannot trace them. But now, with one ID card, anything you do will be tracked, and therefore it’ll become easier for you to be accountable for your actions,” he asserted.

Chief Executive Officer of the Ghana Bankers’ Association, John Awuah, outlined all the activities that the industry is involved in to ensure they are fully prepared to roll out the directive on the stated deadline.

“From the middle of last year, the banking industry has been in stakeholder engagements with the platform developers and the National Identification Authority. There is a standing committee that reviews the ongoing work. So, integration with the Ghana card system has been ongoing in the banking industry for over four to five months now.”

He explained, “There are a few banks that have actually completed the integration work and procurement for devices has also started. We have every confidence in the deadline that has been established by the Bank of Ghana. The industry should be prepared to roll out Ghana cards as the primary source of identification.”

The Central Bank’s direct will affect licensed and regulated financial institutions, including banks, Specialised Deposit-Taking Institutions; Non-Deposit-Taking Financial Institutions; Payment Service Providers and Dedicated Electronic Money Issuers; Forex Bureaus and Credit Reference Bureaus.

BoG further explained that the National Identification Authority verification transaction platform will be integrated into the Bank of Ghana’s financial monitoring platform to ensure that all financial transactions performed within the ecosystem are linked to one identity and information, to facilitate the identification of initiators/beneficiaries for track and trace purposes.

Customers of the various regulated financial institutions are therefore being advised to update their records with their respective financial institutions with the Ghana Card.

Source: citibusinessnews.com