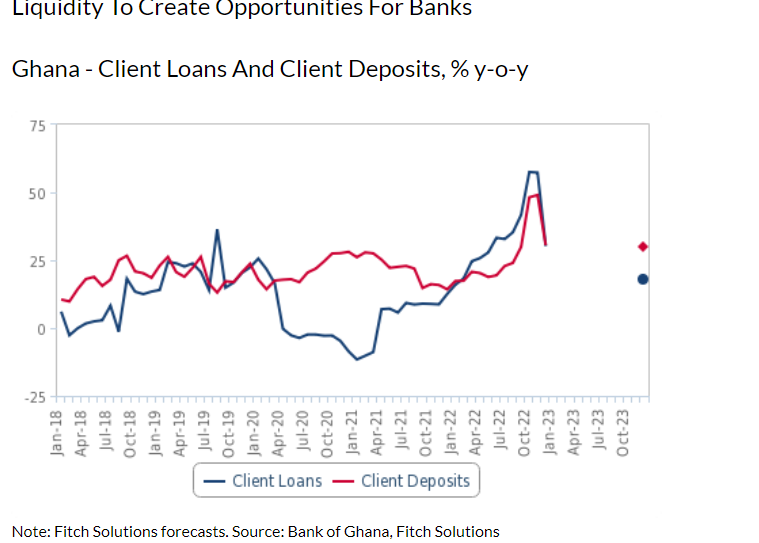

Fitch Solutions has indicated that the banking sector loans will fall considerably in 2023, whilst deposit growth will decline marginally.

It said Ghana’s client loan growth will ease from 30.2% year-on-year in 2022 to 18.0% in 2023.

This is a result of the challenging macroeconomic backdrop, as banks remain uncertain about the possible fallout from the domestic debt restructuring, as well as base effects from very strong loan growth in 2022.

“Whilst our nominal client loans growth forecast will still be in double digits in 2023, skewed by still elevated inflation, our real client loan growth forecast will be much weaker at -7.7% by year-end”, it stated.

“On top of inflation, further interest rate hikes, a weakening currency and a slowdown in economic momentum will continue to act as headwinds to loans growth in 2023.

Deposits growth to fall marginally

On the liabilities side, Fitch Solutions forecasts deposit growth of 30.0% year-on-year in 2023, down marginally from 30.5% in 2022.

A key driver of this strong growth, it said, is the expected depreciation of the cedi in 2023 which will inflate the value of deposits in foreign currency, which account for 28.4% of total deposits, as of December 2022.

Another factor is higher interest rates – the Bank of Ghana (BoG) has hiked the policy rate by a cumulative 1,450 basis points since late 2021.

However, it added that growth in deposits will be held back by the worsening economic environment, as locals will likely have to tap into their savings to compensate for the loss in income.