For most business leaders and economic watchers, many expected a deal to have been sealed, especially during the Executive Board Meeting’s just ended Bretton Woods meeting in Washington, where such major decisions are taken.

This would have brought closure to the government’s long awaited $3 billion financial bailout.

That was not to be, with China, the supposedly “king maker” in Ghana’s debt crises, holding about a third of the country’s external debt, negotiating from a position of strength.

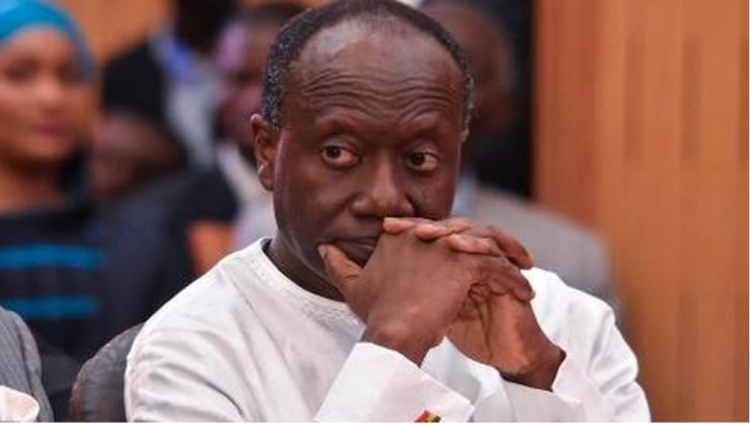

Even though our Finance Minister is overly optimistic that China will come along with regard to our external debt restructuring, the foot-dragging by China is a major source of concern.

The President has also projected that Ghana will seal a deal this month. The country had also enjoyed a whirlwind of support at the Spring Meeting with many countries promising to help the country cross this bridge.

US Vice President Kamala Harris, on her three-day visit to the country, added her voice to calls by the international community to help the country in this debt crises.

The President of the World Bank Group, David Malpass, is quoted to have said during a press conference during the Spring Meeting that China’s insistence that multilateral lenders such as the bank and the International Monetary Fund (IMF) should share losses from ongoing debt restructuring with Ghana and other African countries “does not make sense.”

China’s request for the multilaterals to share losses is one of the major sticking points that is delaying Ghana’s debt restructuring bailout to salvage the economy from suffocating under the huge debts.

At the heart of this critical decision is the geo-political power play, and Ghana seems to be the pawn in the midst of all these.

The signal this sends is very a worrying one that has dire consequences for the economy going forward.

Graphic Business is concerned that there seems to be a lacuna in the information gap. Whiles, the government’s role is to share optimism, the underlining issues and threat to the economy is baring its teeth, and we cannot but help to express concern.

We are worried because the timelines kept shifting from March to April, to May and now the rating agencies are predicting June to have a clear understanding of the way forward. There seem to be no end in sight.

These are the conditions that make speculators take advantage to ran riot on the currency.

Ghana experienced this situation last year, which has thrown every economic projections out of the window for many businesses. Therefore, at this stage, the least the economy needs right now is a semblance of what happened last year.

Perhaps it is about time we went back to the IMF with a revised plan that would take into consideration the exigencies of the time.

Mindful of the fact that the IMF itself is looking out for the funding for its overstretched budget, the earlier we engaged to forestall an economic disaster the better.

The question we ask of authorities at this precarious state is what are the options opened to us as a country?

We need answers to this question. For how long should we hold on to the hope that we will soon reach the much-awaited deal?

Source: Graphic Online