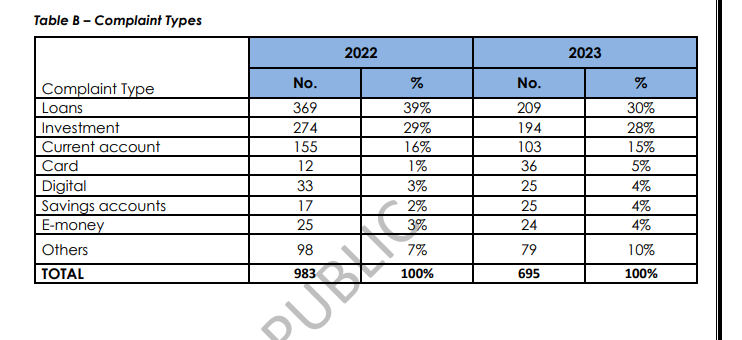

The highest complaint type received by the Bank of Ghana in 2023 was loans.

According to the 2023 Complaints Management Report, the Central Bank recorded 209 (30%) of total complaint as loans.

These complainants registered their dissatisfaction with the personal, business and mortgage loans they secured from regulated institutions.

The main concerns, according to the report, included variations in interest rates and tenure changes on existing loans.

The next highest complaint type was investment products and services which recorded 194 (28%) of total complaints for 2023.

The main concern was the inability to withdraw these investments on maturity due to purported liquidity challenges faced by the institutions.

Current account followed with 103 (15%) of total complaints.

For recurring complaint themes, customers’ inability to retrieve matured investments or deposits topped with 165 complaints, representing 24% of the total complaints received in 2023.

This represented a reduction in complaints related to this theme as compared to 2022 (330).

Loan-related complaints came in second with 127 complaints, representing 18% of total complaints for the year.

Adjudication Outcome

During the complaints resolution process, the Central Bank facilitated the payment of monetary awards/refunds totalling GH3,803 million to deserving complainants.

This represented a 31% increase from GH2.901 million reported in 2022.

The Bank of Ghana concluded, saying, it will continue to ensure compliance with the regulatory framework and educate consumers on their rights and responsibilities which will ultimately preserve financial stability for sustainable economic growth and development.

Also, it remains committed to safeguarding consumers rights and promoting compliance for the soundness and resilience of the banking system.

Source: myjoyonline