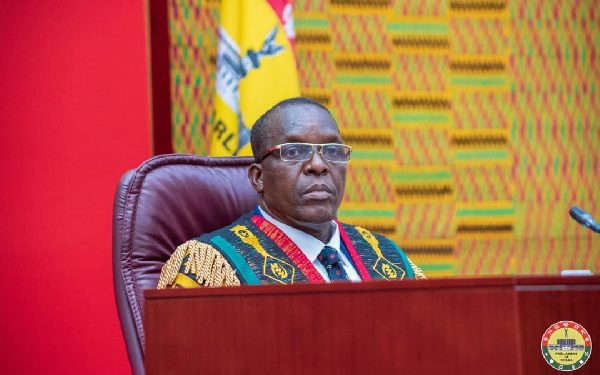

Speaker Alban Bagbin has said he did no wrong by allowing the votes of incapacitated MPs to be counted among the ballots cast in parliament on Friday, 31 March 2023 on some three critical revenue bills.

The MP for Nanton, Mr Mohammed Hardi Tuferu, was involved in an accident on his way to parliament to cast his vote.

The Speaker had leaders of both sides of the house ascertain the MP’s situation when he was driven to the legislature in an ambulance.

After the voting, Mr Bagbin explained: “Members who are incapacitated shall, upon reporting their incapacity to the Speaker, through the Clerk, be recorded”.

“We have some of our members that are incapacitated and what I did was to ask the Whips to go and physically see them to assess their incapacitation and whether they are of sound mind”, he added.

“I did not do anything untoward. I only followed the rules”, Mr Bagbin added.

$3bn IMF deal: Parliament passes 3 crucial revenue bills

Parliament, despite opposition from the minority caucus, passed the revenue mobilisation bills that are critical for Ghana’s bid to secure a Board-level agreement from the International Monetary Fund regarding a $3-billion extended credit facility to bailout the ailing economy.

They are the Excise Duty Amendment Bill 2022, the Growth and Sustainability Levy Bill, 2022, the Ghana Revenue Authority Bill 2022 and the Income Tax Amendment Bill 2022.

The bills, together, aim to accrue some GHS4 billion for the country annually.

Ahead of Friday’s vote, both the Governor of the Bank of Ghana, Dr Ernest Addison and Minister of Information, Mr Kojo Oppong Nkrumah, had, separately urged parliament to pass the bills quickly to help salvage the economy.

Mr Nkrumah warned that Ghana’s already-imperiled economy will take a further tumble if the bills were not passed.

“If we don’t do what we have to do for the country, we will have major challenges”, he noted, indicating that the bills are “a set of measures we must ensure is worth passing”.

“This is a major bridge we have to cross in closing this revenue gap and ensuring that there is more liquidity”, Mr Oppong Nkrumah told Accra-based Citi TV.

Mr Oppong Nkrumah said the economic situation is dire and needs urgent salvaging.

“We are not in a good place because we don’t have access to the international capital market”, he explained.

The Ofoase Ayirebi MP also complained: “Having hard currency to service our import obligations is significantly being threatened”.

“It is important we complete all prior actions, lock up this deal and get a shore up best from the IMF and other inflow sources and do certain broad things to ensure that the economy doesn’t crash and expand investments that will bring economic inclusion”.

“We need to do what must be done to ensure that we cement the kind of relative stability we have had in the last four to five months and gradually begin to reverse the economic challenges we have had”, he urged.

Budget: BoG, MoF to sign zero-financing MoU; Governor urges parliament to pass revenue bills to clinch $3bn IMF deal

The Bank of Ghana and Ministry of Finance have drafted an MoU for zero-financing of the budget.

The central bank governor, also told journalists on Monday, 27 March 2023 at the central bank’s Monetary Policy Committee meeting that it will be signed soon.

“On fiscal policy, the Committee noted that the budget statement for 2023 has set fiscal policy on a consolidation path which is consistent with key elements agreed with the IMF at the staff level in December 2022”, he said, adding: “The domestic debt exchange, new revenue measures, and structural fiscal reforms will provide significant reduction of debt service and help create fiscal space”.

He said the fiscal outlook is “contingent on financing of the budget and will require the conclusion of the domestic debt exchange programme as well as securing the requisite financing assurances from bilateral donors”.

“Indications are that these discussions are proceeding well. Based on the above, it is imperative that parliament prioritises the passage of the revenue bills currently before it”.

He added: “Under the staff-level agreement with the IMF, the Bank of Ghana and the Ministry of Finance have finalised a Memorandum of Understanding on zero-financing to the budget, which will be signed shortly”.

According to him, the passage of the relevant revenue bills by parliament will, therefore, conclude the required prior actions to advance Ghana’s programme to the IMF Executive Board.

“This will be critical in resetting the economy on the path of recovery, including putting it firmly on a disinflation path and sustained growth”.

Read the MPC’s full statement below:

Good morning, ladies and gentlemen of the media and welcome to the press briefing after the 111th Monetary Policy Committee (MPC) meetings which took place last week.

The Committee deliberated on recent macroeconomic developments and assessed the current state of the economy and risks to the inflation and growth outlook.

A summary of the assessment and key considerations that informed the Committee’s decision on the stance of monetary policy is provided below:

Source: classfmonline.com