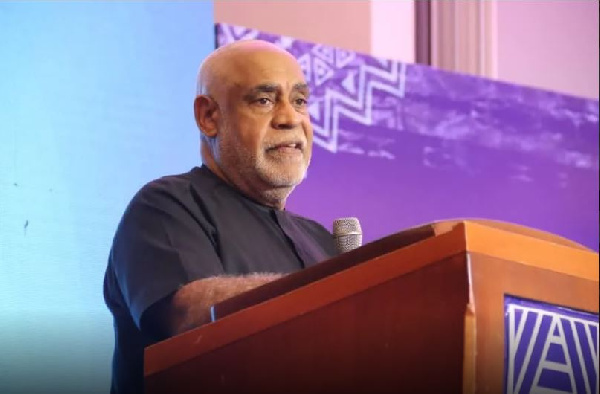

The United Nations (UN) Resident Coordinator in Ghana, Charles Abani, has indicated that small and medium-scale enterprises (SMEs) are only able to access a paltry 0.41 percent of the required capital they need to scale up

He said sources of SME financing in Ghana, such as private equity and venture capital (PEVC) account, form an estimated US$25million per year; a small sum compared to the financing need of US$6.1billion.

Mr. Abani stressed that to overcome these challenges and unlock the private sector’s full potential, deliberate actions are essential to garner patient capital for the private sector.

He emphasised that SMEs generate significant revenue and profits, and remain a significant anchor to the local economy; however, without more funding their full potential cannot be harnessed for economic development and improved standards of living.

“In Ghana, although SMEs generate significant revenue and profits, they require an estimated US$6.1billion in financing to scale. In addition, other sources of SME financing in Ghana like the private equity and venture capital (PEVC) industry account for an estimated US$25million per year – a small sum compared to the financing need,” he said.

The UN rep maintains that small business solutions play a pivotal role in building a stronger and more inclusive global economy, catalysing progress toward the Sustainable Development Goals (SDG).

“SMEs are the backbone of economies, particularly in sub-Saharan Africa (SSA) where they are estimated to constitute 90 percent of businesses – employing 80 percent of the workforce and contributing 70 percent to gross domestic product (GDP); and nearly half, 46 percent, of these are owned by women.

“SMEs thus present opportunities for significant environmental, social & development impact and inclusive growth. Yet, often, their potential for contributing to broader societal goals is underestimated,” Mr. Abani added.

Source: thebftonline.com