Note: The numbers in the graphs may not add up to 100 per cent because figures have been rounded up/down. The survey also highlighted significant regional divergence in growth expectations within a general pattern of weakened expectations relative to the last survey.

The situation in Europe and the US is now stark, with 100 per cent of chief economists expecting weak or very weak growth this year in the former and 91 per cent expecting weak or very weak growth in the latter. This marks a significant deterioration in recent months: at the time of the last survey, the corresponding figures were 86 per cent for Europe and 64 per cent for the US.

The extent of the deterioration in the European outlook is also reflected in the latest round of IMF forecasts: while global growth for 2023 was trimmed by 0.2 percentage points, the forecast for the Eurozone slumped from 1.2 per cent to 0.5 per cent.

In the US, the pace and extent of monetary tightening will exert a significant drag on economic activity this year.

The survey results for the 2023 outlook in China are polarized, with almost half of respondents now expecting weak or very weak growth in China, with the other half expecting moderate or even strong growth.

Recent moves to unwind the country’s highly restrictive zero-COVID policy are expected to deliver a boost to growth. However, it remains to be seen how disruptive the policy shift will be, particularly in terms of the health impacts of COVID-19’s expected rapid spread through the population. A number of additional factors are likely to weigh on China’s growth in 2023, such as weak consumer confidence, missing the 5 per cent growth target for 2022 and continued strain in financial markets and the real-estate sector.

The two strongest regions in 2023 according to the survey are the Middle East and North Africa (MENA) and South Asia. In South Asia, 85 per cent of respondents expect moderate (70 per cent) or strong (15 per cent) growth, a modest improvement since the September edition.

In MENA, two-thirds of respondents(70 per cent) expect moderate or strong growth in 2023. While this overall proportion has slightly dipped since the September edition, expectations of strong growth have increased from 12 per cent to 15 per cent. Energy exporters in the region continue to benefit from tight commodity markets, but oil prices have fallen by almost 25 per cent since June 2022 and these countries will be vulnerable to the impacts of any slowdown in global growth in 2023.

In the East Asia and Pacific region, 37 per cent of chief economists expect weak growth in 2023, and 63 per cent expect moderate or strong growth, similar to September.

However, that broad pattern masks a shift in expectations from strong to moderate growth since the last survey.

During that period, the region has seen negative terms-of-trade developments, as well as policy tightening moves that placed increased pressure on households and businesses.

Challenging global financial conditions are also weighing on the economic outlook for Latin America and the Caribbean, and for Sub-Saharan Africa. For both regions, 68 per cent of respondents expect weak growth in 2023.

This is a slight improvement for Sub-Saharan African but points to a worsening of conditions for Latin America and the Caribbean.

Inflation moderates, but slowly Inflation over the last year was stubbornly high and broad-based, but a number of modestly encouraging data releases in the final quarter of 2022 provide some room for optimism over the medium-term inflation outlook in 2023.

A range of factors have contributed to a slight easing of the rate of inflation, including rapid and synchronized monetary tightening, stabilization of supply conditions and commodity prices, and an easing of demand pressures.

The latest IMF forecast is that global inflation will dip to 6.5 per cent this year from 8.8 per cent in 2022.

Outlook

For Europe, this is likely to reflect the deepening impact of the ongoing war in Ukraine as well as the effects of sharp Increases in interest rates. The combination of high energy prices, elevated borrowing costs and sluggish demand has even led to instances of industrial capacity being left idle. With about half of the EU steel plants at a standstill as of November 2022 and fertilizer production capacity reduced by70 per cent, the European industrial sector is facing a challenging year ahead.

Some economies in the region, including Bangladesh and India, may benefit from global trends such as a diversification of manufacturing supply chains away from

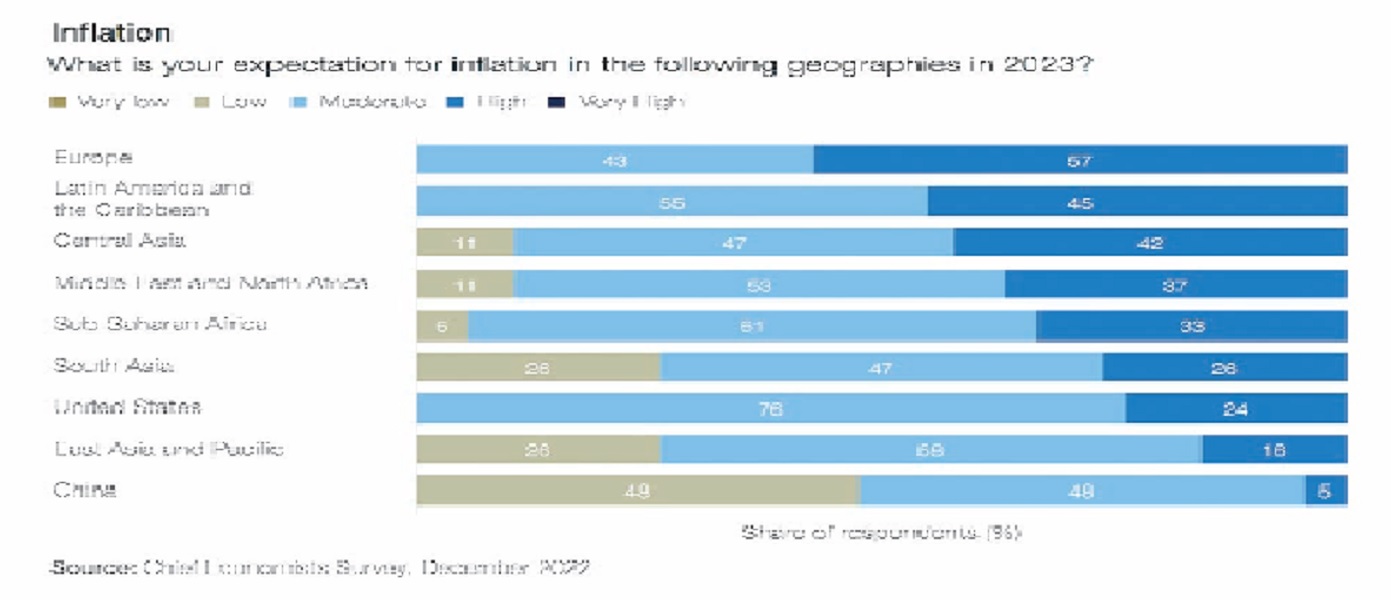

Although no regions are slated for very high inflation, expectations of high inflation range from 57 per centof respondents for Europe to just 5 per centof respondents for China.

The direction of changes in responses since the last edition differs from region to region. For example, the proportion of respondents expecting high inflation in Europe has increased from 47 per cent to 57 per cent since September, while for the US, it has declined sharply from 43 per cent to 24 per cent.

The expectation is for moderate inflation throughout 2023 in several regions: SubSaharan Africa (61 per cent), East Asia and Pacific (58 per cent), MENA region (53 per cent) and South Asia (47 per cent).

By contrast, in Latin America and the Caribbean and Central Asia, relatively high shares of respondents expect high inflation (45 per cent and 42 per cent, respectively).

This is likely to reflect a combination of supply chain disruptions from the war in Ukraine as well as the continuing impact of spikes in food and fuel prices during 2022.

China is an outlier in the other direction, with almost half of respondents (48 per cent) expecting low inflation (up from 28 per cent in September). As noted above, however, the short-term outlook for the Chinese economy is clouded by uncertainty surrounding the speed of the country’s removal of pandemic restrictions.

If a full re-opening leads to a sharp recovery in economic activity, it would be likely to push Chinese prices significantly higher than previously seemed likely, as well as adding new impetus to global inflationary pressures.

Policy-makers face trade-offs

The global backdrop of weak growth and persistently high (albeit moderating) inflation presents policy-makers with challenges of historic proportions at the start of 2023.

Chief among these will be the need to bring inflation much closer to the 2 per cent target without choking off growth, but the challenges run deeper.

Accumulated societal strains from the last years as well as climate mitigation and adaptation present pressing investment needs in numerous countries.

In the immediate term, central banks are the key economic decision-makers. Following a year of sharp and coordinated tightening, the chief economists surveyed expect the monetary policy stance to remain constant in most of the world this year.

In Europe and the US, a majority of respondents (59 per cent and 55 per cent, respectively) expect further tightening in 2023. The Federal Reserve and the European Central Bank have both indicated that such additional tightening is on the way, but it is notable that the two banks’ most recent rate increases in December were smaller, at 50 basis points, than previous 75 basis point hikes in the current tightening cycle.

Nonetheless, a quarter of respondents expect looser monetary policy in the US and Europe by the end of 2023.

Source: Graphic online