The Monetary Policy Committee (MPC) of the Bank of Ghana has implemented a tighter monetary stance in response to emerging upside risks to inflation.

This move will have significant implications for Treasury securities, particularly 91-day to 365-day T-bills as they will endure an extended period of higher yields.

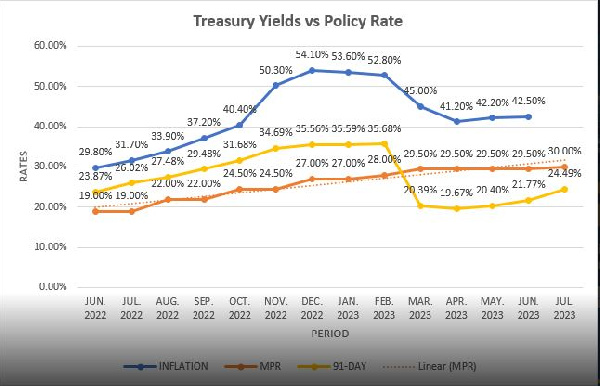

During its July 23 policy meeting, the MPC raised its policy rate by 50 basis points (bps) to 30 percent. This increase is aimed at countering inflation risks and calls for substantial tightening in both the fiscal and monetary policy frameworks. The Committee noted a cumulative 130 bps increase in headline inflation over the past two months, with inflation risks primarily driven by relentless food prices.

Though the 50 bps hike is considered marginal and precautionary, market observers such as GCB Capital have suggested that it may lead to higher interest rate demand and potentially moderate credit growth in the interim.

Since Q1 2023, inflation and general macroeconomic uncertainties have spurred higher interest rates, causing benchmark 91-day bill yields to revert from 18 percent to potentially breach 25 percent at the next auction. This upward trend in yields follows government’s short-lived efforts to reduce bids and capitalise on strong demand for bills to lower borrowing costs.

Consequently, yields on the 91-day bill dropped from 35.36 percent in Q4-2022 to 19.39 percent in Q1-2023, while the 182-day bill declined from 35.98 percent to 21.44 percent and the 364-day bill fell from 35.89 percent to 25.66 percent during the same period.

At the most recent auction held on July 21, 2023, yields settled even higher with the 364-day bill clearing at 30.05 percent (+40 bps w/w) and the 182-day bill surging to 26.91 percent (+50 bps w/w), while the 91-day yield increased at a relatively slower pace to 24.92 percent. Cumulatively since Q1 2023, yields on the 91-day have surged by 553 bps while the 182-day and 364-day bills have surged by 547 bps and 439 bps respectively.

These higher T-bill yields now surpass the coupon rates on restructured bonds, and the tighter monetary stance may lead to even higher yields until the Treasury accesses concessional funding alternatives.

Moreover, the rising borrowing costs for government, driven by higher yields on Treasury bills, are further straining an already burdened fiscal position. As government borrowing costs increase, managing existing debt burdens and fulfilling future financial commitments become increasingly challenging.

Despite efforts to restructure the country’s debt portfolio, the updated public debt stock – excluding debt from state-owned enterprises and special purpose vehicles (SOE/SPVs) – reflects significant growth mainly due to an increasing domestic debt burden and exchange rate movement earlier in the year.

According to the BoG’s summary of macroeconomic and financial data published in July 2023, the total debt stock increased by 21.3 percent from December 2022 to GH¢569.3billion (71.1 percent of GDP) in April 2023. The domestic debt component rose by 6.29 percent, amounting to GH¢15.6billion and reaching GH¢247.9billion (30.95 percent of GDP), while external debt in cedi terms surged by 33.41 percent, totalling GH¢80.5billion and amounting to GH¢321.4billion (40.13 percent of GDP).

Treasury auctions ahead

The Treasury faces upcoming Treasury bill maturities on July 31, 2023, with a total face value of GH¢2.02billion across the 91-day and 182-day bills. To roll over these maturities, the Treasury aims to conduct a gross issuance of GH¢2.28billion at the next T-bill auction later in the week.

Despite the interbank market remaining broadly liquid, the 50 bps increase in policy rate to 30 percent may result in a sharper increase of T-bill yields at the next auction. It is expected that the benchmark 91-day yield will exceed 25 percent at this auction.

Market expectations indicate that yields on Treasury bills will continue to fluctuate in the near-term, with the potential for further increases. However, the real return on Treasury bills will remain negative until inflation returns to a single-digit figure or drops below 20 percent. The projected range for Treasury yields in the near-term is around 20 percent to 25 percent.

Source: thebftonline.com